Jump Partners with Wealth.com on Estate Planning: A Comprehensive Guide

Estate planning is a critical aspect of financial management that ensures your assets are distributed according to your wishes after you pass away. Recently, Jump announced a strategic partnership with Wealth.com to enhance estate planning services. This collaboration aims to provide comprehensive solutions to help individuals secure their financial future. In this guide, we will delve into the details of this partnership, the importance of estate planning, and how this collaboration can benefit you.

Understanding Estate Planning

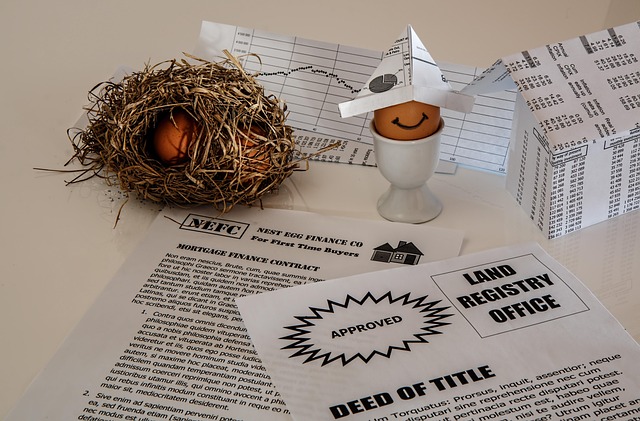

Estate planning involves creating a plan for the management and distribution of your assets after your death. It includes drafting a will, setting up trusts, and designating beneficiaries. Proper estate planning can help avoid family conflicts and ensure that your assets are distributed as per your wishes.

The Importance of Estate Planning

Estate planning is not just for the wealthy; it is essential for everyone. According to a recent report by The Globe and Mail, financial matters, including estate planning, are crucial for achieving long-term financial goals. Without a proper estate plan, your assets may not be distributed as you intended, leading to potential conflicts among family members.

Common Estate Planning Mistakes

- Not Having a Will: Dying without a will can lead to legal complications and family disputes. It is essential to have a legally binding document that outlines your wishes.

- Not Updating Your Plan: Life changes such as marriage, divorce, or the birth of a child necessitate updates to your estate plan.

- Ignoring Tax Implications: Proper estate planning can help minimize tax liabilities for your heirs.

The Jump and Wealth.com Partnership

The partnership between Jump and Wealth.com is a strategic move to enhance estate planning services. This collaboration aims to provide clients with comprehensive financial solutions, including investment strategies and estate planning.

Benefits of the Partnership

- Comprehensive Financial Solutions: The partnership offers a wide range of financial services, including investment management and estate planning, to help clients achieve their financial goals.

- Expertise and Resources: By combining the expertise and resources of both companies, clients can benefit from a more robust and tailored financial plan.

- Enhanced Client Experience: The collaboration aims to provide a seamless and integrated client experience, making it easier for individuals to manage their financial affairs.

How the Partnership Works

The partnership between Jump and Wealth.com involves integrating their services to provide a holistic approach to financial planning. Clients can access a range of services, including investment management, retirement planning, and estate planning, all under one roof. This integration ensures that all aspects of a client's financial life are considered and managed cohesively.

Investment Strategies for Estate Planning

Investment strategies play a crucial role in estate planning. Proper investment management can help grow your assets and ensure that your heirs receive the maximum benefit. According to a report by Health Canada, US equities have consistently outperformed global peers, cementing their dominance in portfolios worldwide.

Diversification

Diversification is a key investment strategy that involves spreading your investments across various asset classes to reduce risk. By diversifying your portfolio, you can protect your assets from market volatility and ensure a steady growth trajectory.

Quality Growth Stocks

Investing in quality growth stocks can significantly enhance your estate's value. For example, companies like Celestica have shown consistent growth and are ideal for inclusion in your Tax-Free Savings Account (TFSA). The average TFSA balance at 50 is just $30,190 with $57,855 unused, highlighting the potential for growth through strategic investments.

Regular Portfolio Reviews

Regular portfolio reviews are essential to ensure that your investments align with your financial goals. Market conditions and personal circumstances can change, necessitating adjustments to your investment strategy. Regular reviews can help you stay on track and make informed decisions.

Case Studies and Real-Life Examples

Dream Industrial and CPP Investments

In December 2025, Dream Industrial announced a strategic partnership with CPP Investments and an $805 million portfolio recapitalization. This partnership highlights the importance of strategic collaborations in achieving financial goals and securing long-term growth.

Medicare Part B Premium Increase

The standard Medicare Part B premium rose by 9.7% in 2026, from $185 to $202.90, more than three times the 2.8% Social Security bump that year. This increase underscores the need for comprehensive financial planning to account for rising healthcare costs and ensure financial stability in retirement.

Practical Tips for Effective Estate Planning

Start Early

Starting your estate planning early can provide numerous benefits. It allows you to take advantage of compounding growth and ensures that your assets are protected and distributed according to your wishes. Early planning also gives you more time to make informed decisions and adjust your strategy as needed.

Seek Professional Advice

Seeking professional advice from financial advisors and estate planning experts can help you create a comprehensive and effective estate plan. Professionals can provide valuable insights and guidance, ensuring that your plan is tailored to your specific needs and goals.

Regularly Update Your Plan

Regularly updating your estate plan is crucial to ensure that it remains relevant and effective. Life changes such as marriage, divorce, or the birth of a child necessitate updates to your plan. Regular reviews can help you stay on track and make informed decisions.

Conclusion

The partnership between Jump and Wealth.com on estate planning is a significant development in the financial services industry. This collaboration aims to provide comprehensive financial solutions, including investment strategies and estate planning, to help clients achieve their financial goals. By understanding the importance of estate planning, leveraging the benefits of this partnership, and implementing effective investment strategies, you can secure your financial future and ensure that your assets are distributed according to your wishes.

For more information on estate planning and financial management, visit Fintech Global and Wealth.com.